The Bitcoin Halving 2024 Explained

Heard whispers about Bitcoin halving 2024 but not sure what that means. You’re not alone! This event, scheduled for sometime in April, has the potential to significantly impact the cryptocurrency market. But fear not, fellow curious minds! This blog post will break down the Bitcoin halving in simple terms, explore its potential effects, and answer some burning questions you might have.

What is a Bitcoin Halving 2024?

Imagine a giant, digital pie representing all the Bitcoin that will ever exist. The pie is pre-programmed to have a limited size: 21 million coins. Bitcoin halving is like taking a sharp knife and slicing that pie in half – literally. It refers to a pre-coded event in Bitcoin’s programming that cuts the reward miners receive for verifying transactions by 50%.

Why Does Halving Happen?

Think of miners as the bookkeepers of the Bitcoin network. They use powerful computers to solve complex puzzles, validate transactions, and add new blocks to the blockchain, a public ledger that records all Bitcoin transactions. As a reward for their work, they get newly minted Bitcoins.

The halving mechanism was built into Bitcoin’s code by its creator, Satoshi Nakamoto. Its purpose is twofold:

-

Control Supply: Just like with any valuable resource, scarcity plays a role in Bitcoin’s price. By gradually reducing the number of new Bitcoins entering circulation, halving helps maintain scarcity over time.

-

Security Incentive: Mining requires significant computing power and electricity. The reward keeps miners incentivized to secure the network and prevent fraudulent transactions.

A Look Back at Previous Halvings:

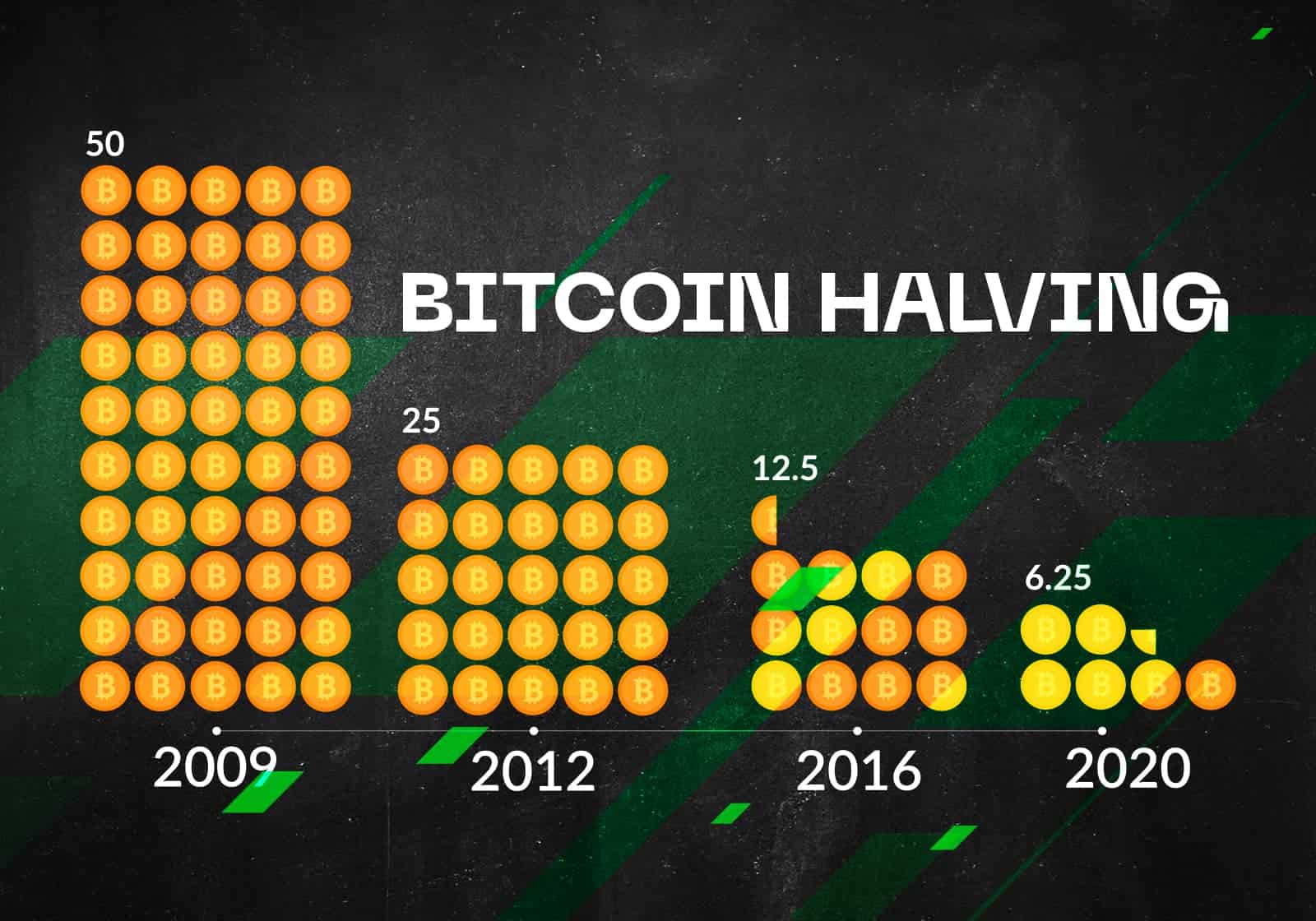

Bitcoin has undergone three halving events before:

- November 2012: The reward dropped from 50 BTC to 25 BTC per block.

- July 2016: The reward went from 25 BTC to 12.5 BTC per block.

- May 2020: The reward halved again, from 12.5 BTC to 6.25 BTC per block.

Interestingly, all three halving events were followed by significant price increases for Bitcoin, though the timeframe for these increases varied. However, it’s important to remember that correlation doesn’t equal causation. Other market factors can also influence Bitcoin’s price.

What to Expect in the Bitcoin Halving 2024:

The upcoming halving will see the reward decrease from 6.25 BTC to 3.125 BTC per block. This will further limit the number of new Bitcoins entering circulation each year.

Potential Impacts of the Bitcoin Halving 2024:

Here are some potential consequences of the 2024 halving:

-

Increased Bitcoin Price: If history repeats itself, we might see a rise in Bitcoin’s price due to the ongoing supply squeeze. However, this is not guaranteed and depends on various market forces.

-

More Competition Among Miners: With a lower reward, miners might need to become more efficient to maintain profitability. This could lead to technological advancements in mining hardware.

-

Focus on Transaction Fees: As rewards decrease, transaction fees might become a more significant source of income for miners. This could potentially affect transaction processing times.

Important Considerations:

The Bitcoin halving is a complex event with far-reaching implications. Here are some key points to remember:

-

Short-term volatility: The market might experience increased volatility around the halving date.

-

The long-term impact is unclear: While past halvings suggest a price increase, future performance is uncertain.

-

Do your research: This blog post is for informational purposes only. Always conduct your research before making any investment decisions.

The Final Word:

The Bitcoin halving 2024 is a significant event with the potential to shape the future of cryptocurrency. By understanding its mechanics and potential impacts, you can be better informed about this fascinating digital asset. Remember, the world of cryptocurrency is constantly evolving. Stay curious, keep learning, and make informed decisions!

For More Click Here.

2 thoughts on “The Great Bitcoin Halving 2024: A Beginner’s Guide”