Navigating Taxes: Clarification on the New Tax Regime in India

The new tax regime introduced in India has caused some confusion among taxpayers. To address these concerns, the Ministry of Finance recently issued a 6-point note clarifying the current status and options available. Let’s break down the key takeaways for a clearer understanding.

1. No Change for Now: Breathe Easy!

The most prominent message is that there are no new changes to the new tax regime as of April 1, 2024. This means the existing rules and options remain in effect for the current financial year.

2. Recap: New Tax vs. Old Tax Regime

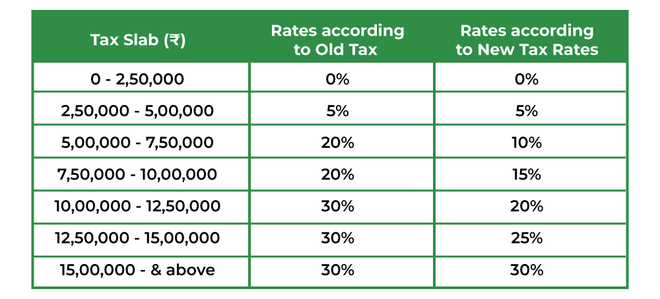

As a reminder, India offers two tax regimes for individual taxpayers (excluding companies and firms):

- Old Regime: This traditional regime allows for various deductions and exemptions, potentially lowering your taxable income. However, the tax rates themselves can be higher in certain income brackets.

- New Regime: Introduced in 2023, this regime offers lower tax rates compared to the old regime. However, it comes with fewer deductions and exemptions.

3. The Default Choice with Flexibility

The new tax regime is currently the default option for individuals filing their taxes for the Assessment Year 2024-25 (income earned in Financial Year 2023-24). However, there’s good news!

4. You’re in Control: Opting Out is an Option

Taxpayers can opt out of the new regime and choose the old one if it proves more beneficial in their specific case. This option is available until the filing of returns for the Assessment Year 2024-25.

5. Weighing Your Options: A Crucial Decision

Choosing the right tax regime depends on your financial situation. Here are some factors to consider:

- Income Level: Taxpayers in lower income brackets might benefit more from the lower tax rates of the new regime.

- Deductions and Exemptions: If you claim significant deductions (e.g., HRA, medical expenses) or exemptions (e.g., Section 80C investments), the old regime might be more advantageous.

6. Resources for Informed Decisions:

The Ministry of Finance website and tax consultants can be valuable resources to help you calculate your taxes under both regimes and determine the most suitable option for your situation.

In Conclusion

The Ministry of Finance’s clarification on the new tax regime offers much-needed clarity for taxpayers. Remember, you have the flexibility to choose between the new and old regimes based on your circumstances. By carefully considering your income level, deductions, and exemptions, you can make an informed decision and potentially save on your tax liability.

For More content Click Here.